Belles Demeures – luxury real estate and exceptional properties

The fall in prices seen for existing properties has not occurred for exceptional properties

While existing property has suffered from the tightening of credit conditions over the last two years, the same cannot be said for prestige property. On the contrary, prices in the luxury goods market are up by +1.7% in France over one year, compared with -2.5% for the traditional market… Are prices for these exceptional properties rising all over the country? Are the most luxurious seaside resorts still just as attractive? The prestige real estate website Belles Demeures takes stock of this vibrant market and reveals the prospects for future buyers and sellers of these exceptional properties*.

In France, luxury and ultra-luxury real estate continues to appeal

Luxury resists in a complex economic and banking environment. With fewer than 9,000 transactions worth more than €1.2 million and some 870 exceptional sales worth more than €3.2 million in France last year, The French luxury property market is enjoying solid growth of +2.3% for houses and +1.1% for flats on average over the year.

These performances run counter to those seen in the traditional market, with -2.1% for houses and -3% for flats over the same period. One of the primary explanations for this is the very slight impact of the rise in interest rates for this premium clientele. In fact, more than half (54%) of the future buyers surveyed by Belles Demeures said that the rise in interest rates had no impact on their plans.

These performances run counter to those seen in the traditional market, with -2.1% for houses and -3% for flats over the same period. One of the primary explanations for this is the very slight impact of the rise in interest rates for this premium clientele. In fact, more than half (54%) of the future buyers surveyed by Belles Demeures said that the rise in interest rates had no impact on their plans.

“The last two years have confirmed that the traditional market and the luxury market do not play by the same rules. While buyers in one market are suffering from a rapid and significant rise in interest rates, potentially forcing them to cancel their purchase, luxury buyers on the other side seem to be indulging their real estate cravings.” says Thomas Lefebvre, Vice-Président Data at Belles Demeures (Groupe SeLoger).

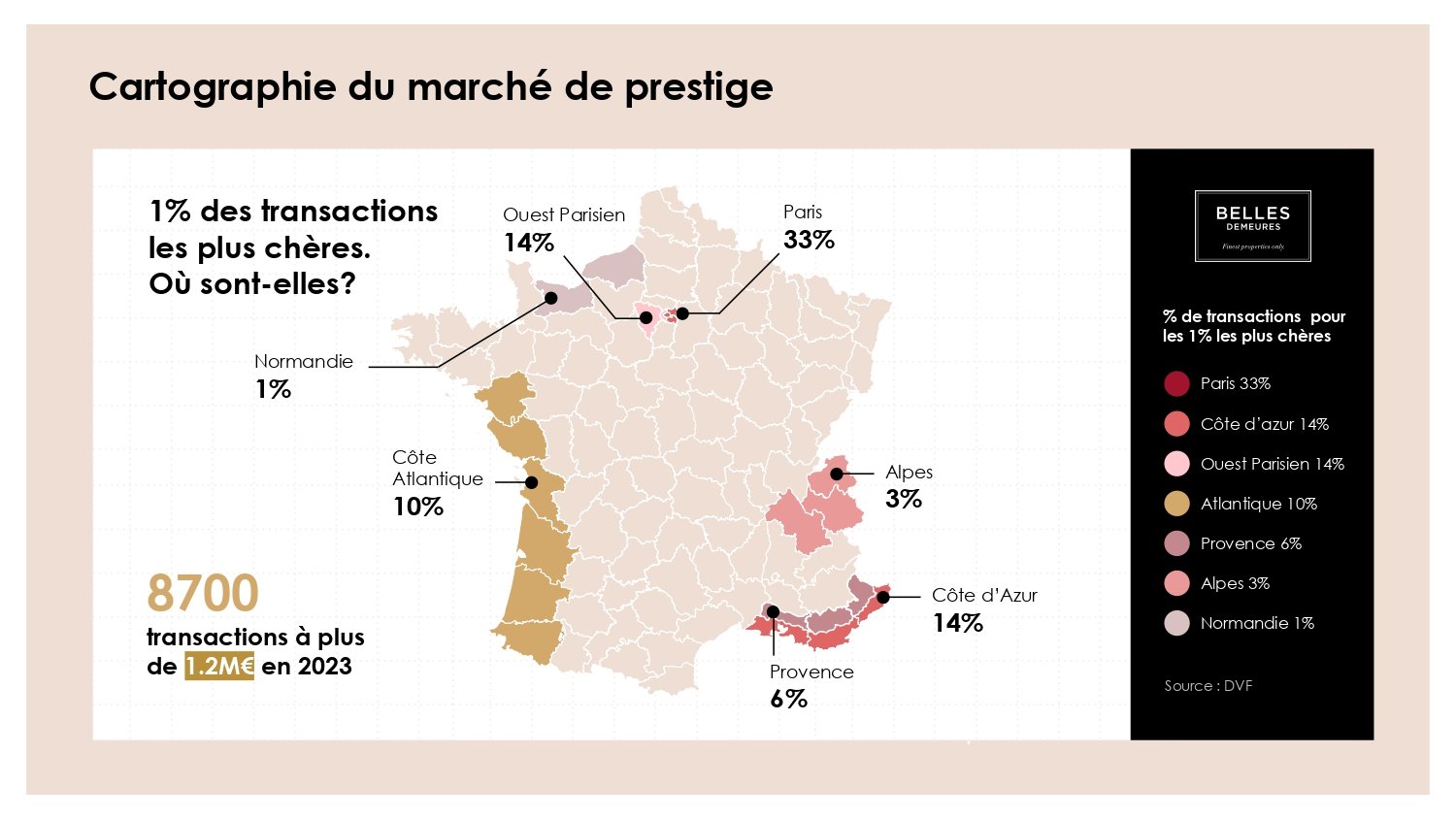

Exceptional property: Paris and coastal regions

In Paris, a fine performance for exceptional properties. The French capital is a prime example of the dissonance between the traditional and luxury markets. In the space of two years, so-called traditional properties have seen their prices fall by 12%, falling back below the symbolic €10,000/m² mark last September, whereas over the same period, luxury flats are holding up well, with growth of +2.2%. The median price of a exceptional flat in Paris 1.7 million (€17,441/sq m) on 1 June 2024. With even more exceptional features, the median price can even reach €4.2 million for ultra-luxury properties.

On the left bank of the Seine, some arrondissements remain close to the top. The property in the 7th arrondissement, with a median price of €3.9 million at 1 June 2024, have recorded growth of +5% over the last two years. Luxury property prices in the 6th arrondissement have risen by 2.1% over the last two years. In the 16th arrondissement, the price of exceptional properties has also risen, by +1.9%. This arrondissement dominates the Paris ultra-luxury market, accounting for 30% of supply and a record median price of €4.7 million.

This observation is confirmed by experts in the prestige market, who add:

“The Paris market is experiencing a confirmed upswing in the upmarket property market. In the first half of this year, Emile Garcin Propriétés recorded a number of sales of flats worth between €4 million and €12 million to celebrities, mainly Americans and businessmen. The Paris market is also reporting a slowdown in the number of transactions, and some sellers are mourning the loss of prices, disappointed at not having benefited from the euphoria of a market that has come to an end. Sales times are getting longer, but in recent weeks we have noticed that the market is starting to open up as soon as the price is justified.” comments Nathalie Garcin, Copresident of Emile Garcin Propriétés.

“All of the transactions carried out in the first half of 2024 by the Daniel Féau Group’s Paris branches show that the Paris residential property market is extremely resilient, with prices now virtually stable. In fact, the fall in prices over 2023 and the first quarter of 2024 has enabled the market to return to a near-normal level of fluidity. This is particularly noticeable for properties with a unit value in excess of three million euros, a segment in which Daniel Féau remains the market share leader.” says Eric Donnet, Managing Director of the Daniel Féau Group.

“Last year was a very positive one for the ultra-luxury market and for Junot Fine Properties – Knight Frank, which achieved record transactions in Paris of between €50m and €80m, with an average price per m² of €30,400. The ultra-luxury market is driven by private mansions (42% of sales), properties with outdoor areas (75% of sales) and turnkey properties (56% of sales). As for buyers, foreigners are in the vast majority (75%), mainly from the United States and Asia.” says Sébastien Kuperfis, Chairman of Junot Fine Properties – Knight Frank.

“Since the beginning of the year, the high-end property market in Paris has maintained relative stability despite the continuing economic challenges. Although prices have fallen slightly on average compared with the previous year, this has been significantly less than feared.” says Richard Tzipine, Chief Executive Officer of Barnes.

What’s more, this interest in exceptional Parisian properties seems to be long-term, with little sensitivity to ephemeral events, however prestigious. While it is true that Paris is set to become the capital of the world this summer, only one project developer in five expects the city’s high profile in the media and on social networks during the 2024 Olympic Games to have a significant influence on the market.

The only fly in the ointment: luxury homes in the Paris region

After a long period of remarkable dynamism, sometimes greater than thatn of the capital, exceptional properties in the Paris region are struggling. Luxury homes in Yvelines and Hauts-de-Seine, with median prices of €1.3 million and €1.4 million respectively, recorded price falls of -5.1% and-3.2% year-on-year. The town of Neuilly-sur-Seine stands out, accounting for 40% of the private mansions on offer in western Paris at a median price of €5.7 million.

“Unlike Paris, which can count on an international clientele with very little dependence on credit, buyers wishing to become owners of a luxury home in the Paris Region are often Parisian households who, although well off, still need to use credit to buy their family property. The price trends seen for this type of property in the Paris region are a direct consequence of the doubling of interest rates in two years.” Says Thomas Lefebvre, Vice-Président Data at Belles Demeures (SeLoger Group).

“In the west of Paris, thanks to our offices in Neuilly, Boulogne, Saint-Cloud, Versailles and Saint-Germain-en-Laye, we are seeing a less buoyant market for family properties where bank financing is planned. Nevertheless, these markets remain buoyant for properties with no defects.” According to Eric Donnet, Managing Director of the Daniel Féau Group

Prestige real estate: which areas are the most dynamic?

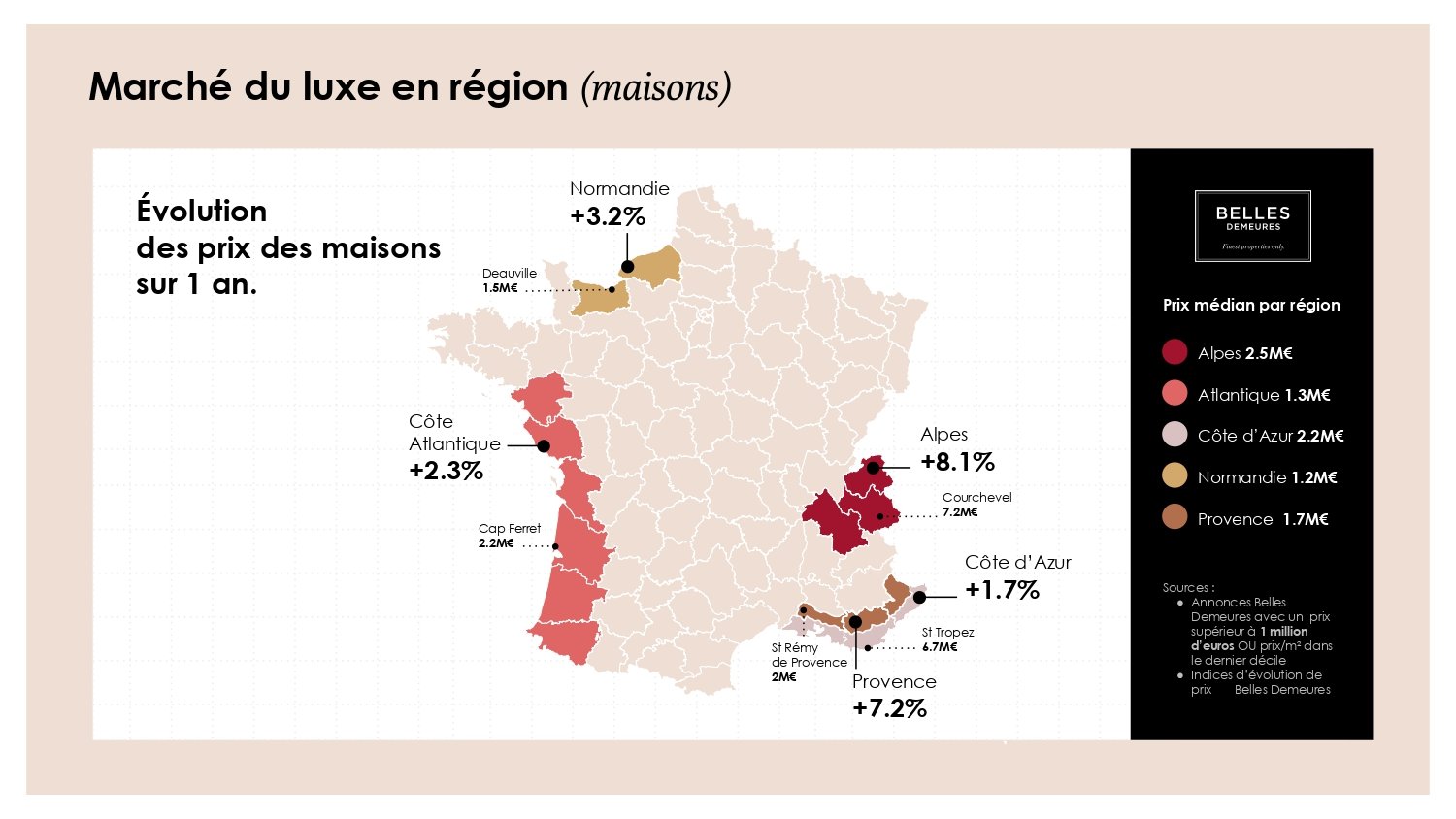

After Île-de-France, the Côte d’Azur is home to the most expensive luxury homes in France, with a median price of €2.2 million (€9,510/sqm) for a property just a stone’s throw from the water. In Saint-Tropez, the median price of exceptional properties in the town even peaks at €6.7 million. According to future buyers surveyed by Belles Demeures, 14% of luxury property projects are located on this Mediterranean coast (compared with 14% in the Paris region).

On the country’s west coast, luxury homes on the Atlantic coast and in Normandy continue to attract buyers, with price rises of +2.3% and +3.2% respectively over one year: expect to pay €2.2 million for an exceptional house in Cap Ferret and €1.5 million in Deauville.

In Provence, a region that also accounts for 14% of respondents’ exceptional property projects, property prices have risen by +7.2% in one year, with a median price of €1.75 million (€7,260/m²) for a house on 1 June 2024. In the town of Saint-Rémy-de-Provence, the median price for a luxury home is even €2 million.

With prices up 8.1% year-on-year in the Alps, chalet prices are reaching record levels, particularly those in Courchevel, where the median price is €7.2 million.

” For the South of France and since the beginning of 2024, the market for character properties remains buoyant. Our business is buoyed by the large number of buyers and the continuing shortage of quality properties. Buyers come from all over Europe, as well as from the United States, which has been very much in evidence since the end of March. They are looking for a change of lifestyle in the south of France, where the quality of the environment attracts them.” says Nathalie Garcin, Copresidente of Emile Garcin Propriétés.

“On the Atlantic coast, it’s the Arcachon basin that’s doing particularly well. Projects have certainly been held back over the last year and a half by the rise in interest rates, particularly in the €2 to €4 million market segment, but we’ve seen a gradual improvement since the start of the year”. comments Richard Tzipine, Chief Executive Officer of Barnes.

Turnkey solutions: a criterion not to be overlooked

In addition to geographical characteristics, the fact that no works are required is an additional criterion for buyers, since 60% are looking for a turnkey property with no work required, and 60% would even be prepared to pay more for such a property.

“In 2024, we are seeing strong demand, particularly from buyers in the Middle East and Asia, who are prepared to spend in excess of €100m on properties that are both historic and turnkey.” says Sébastien Kuperfis, Chairman of Junot Fine Properties – Knight Frank.

Méthodology

*OpinionWay survey conducted from 23 April to 13 May 2024 among 421 respondents

(Belles Demeures) planning to buy or sell a prestige property within the next two years.

Economic analysis carried out by AVIV’s data science team using data from advertisements published by the Belles Demeures website. The calculation of prices and price trends is based on an econometric approach: the hedonic method, which makes it possible to “erase” the effects of other property specificities. The study is based on more than 270,000 ads for properties defined as luxury on the Belles Demeures website since 1 January 2018.

Throughout France, with the exception of Paris, luxury properties are defined by a price of more than €1 million or a price per m2 greater than 10% of the highest prices per m2 per department for transactions between 2021 and 2023 (source DVF). In Paris, luxury properties are defined by a price of more than €1.7 million, which corresponds to 5% of the highest transactions between 2021 and 2023 in Paris (source DVF) or having a price per m2 of more than 5% of the highest prices per m2 in Paris for transactions between 2021 and 2023 (source DVF).

The ultra-luxury segment is defined in Paris by a posted price in excess of €3.2 million, which corresponds to 1% of the highest transactions between 2021 and 2023 in Paris (source DVF) or having a price per m2 in excess of 1% of the highest prices per m2 in Paris for transactions between 2021 and 2023 (source DVF).

The segments are defined as follows:

– Côte d’Azur”: towns in departments 06, 83 and 13 on the coast.

– “Provence”: towns in departments 06, 83 and 13 off the coast.

– “Atlantique: departments 64, 40, 33, 17, 85 and 44

– “Normandie”: départements 14 and 76

– Alpes: towns in departments 73, 74 and 38 that have a ski resort

Further information – Belles Demeures | ggarces@meilleursagents | sarah.kroichvili@groupeseloger.com